Trade Setups

On this Section you will find all our Trade Setups and its related Indicators, Strategies and Systems

With the Indicators it is possible to manually trade the Setup, because they show the Price where we must place the Entry Order.

With the Strategy we can Backtest and Optimize the Settings of the Setup, and of course we can automate its operation.

The Systems offer more flexibility, because they provide Full Automatic and Semi Automatic mode of Operation.

The User can define if trading all the Signals or just the Next Long or Short.

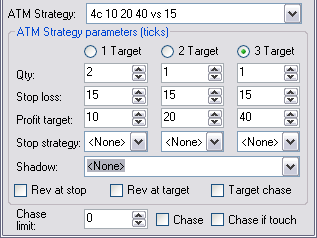

The systems use ATM Orders, so the User can specify a complex trade Size Management ( 3 positions with independent size, target, stop, trailing and auto break even ) and also have full Control of the Orders ( can move and cancel Orders without affecting the logic of the system )

Out Setups :

Refine Search

TIS_ATR_BarColor

New Version 3: User selectable Trailing Method ( as on Supertrend) Trend Direction is ..

$375.00

TIS_EMA_Trader

Available for Ninja 8 The indicator TIS_EMA trades an EMA ( Exponential Moving Averag..

$210.00

TIS_Ichimoku

AVAILABLE for Ninjatrader 7 & 8 This is the classic Ichimoku Indicator including real t..

$250.00

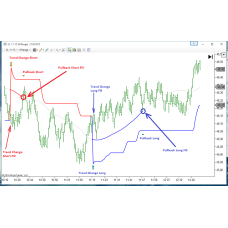

TIS_SRS

This is the TIS_SRS Pullback Setup Indicator Current Version is available for NinjaTrader 7 &..

$299.00

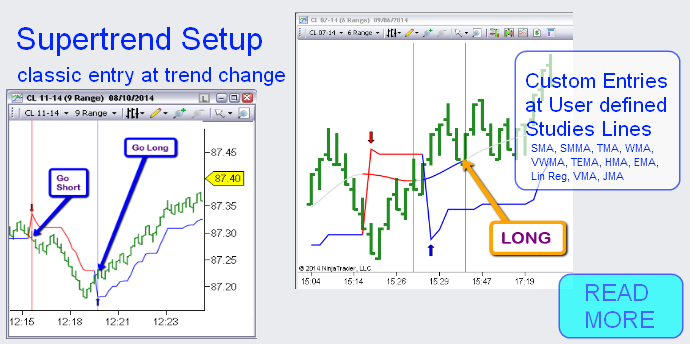

TIS_SuperTrend

NEW Version 3 ready to Download The TIS_Supertrend Indicator is the perfect tool to trade volati..

$150.00 $375.00

TIS_Edge for NinjaTrader

EDGE Setup for NinjaTrader 8 This setup leverages an Exponential Moving Average (EMA) to trade with..

$275.00

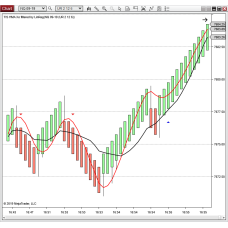

TIS_HMA_Crossover

This indicator was previously named TIS_HMAxoLinReg , now renamed to HMA Crossover and including ( f..

$190.00

TIS_Rebote for NinjaTrader

EMA Rebote Setup ( Compatible with NinjaTrader 7 & 8 ) This Setup trades rebote over an EMA,..

$250.00

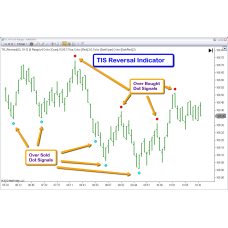

TIS_Reversal

NEW RELEASE 2020 ! Includes NEW Filters And Options ! Linear Regression Slope Filter ..

$199.00

TIS_Impulse_Fast

NEW ! This indicator now Includes a Strategy. Click here to download. ( it needs the indicator to wo..

$150.00

TIS_Slope_Color_Trend

NEW - AVAILABLE FOR NINJATRADER 8 The TIS_Slope_Color Indicator allows to detect..

$150.00 $250.00

TIS_Price_Action

NEW RELEASE FOR NINJATRADER 8 : 2021-05 Compatible with Builder ( Example Strategy included ) Th..

$250.00

TIS_Bollinger_Trender for NinjaTrader

Bollinger Trender Setup ( Compatible with NinjaTrader 7 & 8 ) This Setup is similar to the B..

$199.00 $250.00

Risk Disclosure

RISK DISCLOSURE :

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

HYPOTHETICAL PERFORMANCE DISCLOSURE :

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

-228x228.png)

-228x228.png)