New 2024 Indicator

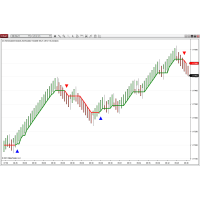

The ATR Trend indicator uses a trailing ATR to detect trend changes and also to define the Trend.

It is similar to TIS_Donchian_Trend but by using the ATR to define the trend is is more inmune to volatility changes.

It has multiple configurations options and can be used to create entry signals and also trend filters.

Its outputs are compatible with Builder and Markers to automate its signals

Visit Us on the Chat Room for More Info at : https://discord.gg/khCxe3H

Related Products

Woodies Trend

New 2021 Indicator from Woodie's Tools The Woodies Trend indicator detects Market Trend Changes ..

$249.00

Woodies Cloud

New 2022 Indicator from Woodie's Tools The Woodies Cloud indicator uses two Woodies Trend l..

$299.00

TIS_Donchian_Trend

New 2023 Indicator The Donchian Trend indicator uses Donchian Channels to detect trend changes a..

$300.00

Combo ATR Trend + Markers 2025 - TWO IDs

15% Discount ! Get the Combo ATR_Trend with Markers 2025 (for two computers) at just $1190 ..

$1,400.00

Combo ATR Trend + Markers 2025 - ONE ID

15% Discount ! Get the Combo ATR Trend with Markers 2025 (for one computer) at just $6..

$764.00

Template for ATR_Trend

NinjaTrader 8 Chart Template – Optimized ATR_Trend Setup for NQ & ES.This NinjaTrader 8 chart te..

$150.00

TIS_ATR_Trend + Template

NinjaTrader 8 TIS_ATR_Trend indicator + Chart Template – Optimized ATR_Trend Setup for NQ..

$450.00

Risk Disclosure

RISK DISCLOSURE :

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

HYPOTHETICAL PERFORMANCE DISCLOSURE :

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.