RELEASE 2025

- Compatible with Fast Signals

- It can be easily automated with Markers or Builder

- Linear Regression Slope Filter

- EMA Position & Slope Filter

-

PinBar Filter ( Reversal Bar must have a user defined wick size )

- Include Stochastic Peaks Signals ( Allows Reversal Bars where only one Bar is on the Over Bought/Sold Area )

- Alert Sounds

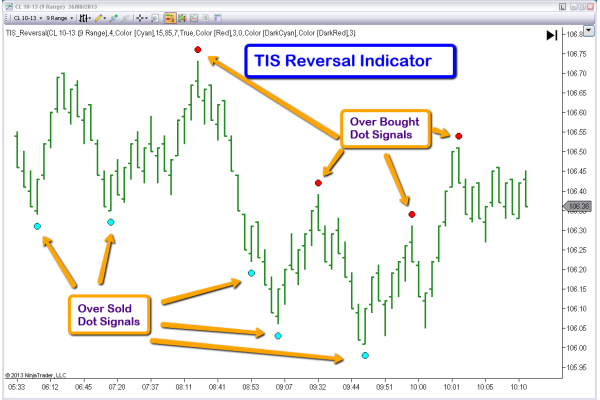

TIS_Reversal is an advanced reversal bar detection tool with multiple filtering options: linear regression slope, EMA position and slope, customizable PinBar conditions, and stochastic exhaustion. Fully automatable and ideal for detecting high-probability reversal signals.

Key Features:

✅ Detects reversal bars with multi-layered filtering

✅ Linear regression slope filter

✅ EMA position and slope filter

✅ Optional PinBar filter with wick size control

✅ Built-in stochastic exhaustion detection

✅ Compatible with Markers and Strategy Builder

✅ Fully integrated with NinjaTrader 8

Who is it for?

Ideal for traders who focus on market reversals and want reliable, filtered, and automatable entry signals for confident trading.

This Indicator is a good solution to trade reversals, it filters overbought and oversold Market Conditions using a Stochastic Indicator.

The levels of the Stochastic are fully configurable and it works intrabar offering confirmed ( after bar close ) signals and unconfirmed ( intrabar ) signals.

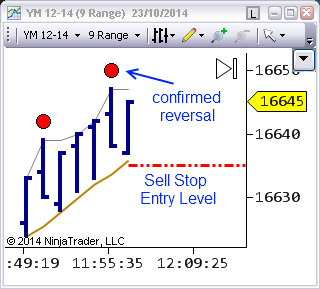

Includes RBO (Reversal Breakout Order ) logic for Alternate Entries and Displays Entry with an Horizontal Line

For Manual Trading we just need to place the Entry Order ( Buy Stop for a Long and Sell Stop for a Short ) over the dotted line

Read More about it on this Blog Post

Related Products

TIS_SRS

TIS_SRS is a specialized indicator that detects pullback setups with high precision on any chart typ..

$299.00

Combo Reversal + Markers 2025 - TWO IDs

15% Discount ! Get the Combo Reversal with Markers 2025 (for two computers) at just $1105 ..

$1,300.00

Combo Reversal + Markers 2025 - ONE ID

15% Discount ! Get the Combo Reversal with Markers 2025 ( for one computer) at just $602.65..

$709.00

Template for Reversal

NinjaTrader 8 Chart Template – Optimized Reversal Setup for NQ & ES.This NinjaTrader 8 chart tem..

$150.00

TIS_Reversal + Template

NinjaTrader 8 Chart Template – Optimized Reversal Setup for NQ & ES.This NinjaTrader 8 chart tem..

$350.00

Risk Disclosure

RISK DISCLOSURE :

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

HYPOTHETICAL PERFORMANCE DISCLOSURE :

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.