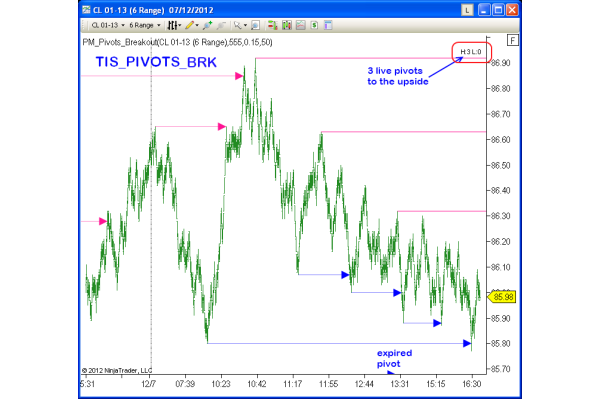

TIS_Pivots_Breakout automatically detects swing highs and lows (pivot levels) based on bar structure and triggers signals when those levels are broken. It's a powerful tool for spotting breakout zones with high probability of momentum continuation.

Key Features:

✅ Automatically detects major pivot highs and lows

✅ Adjustable strength and minimum distance between pivots

✅ Prints breakout signals when pivots are breached

✅ Fully compatible with Markers Lite & Plus for automation

✅ Displays number of unbroken pivots above and below market

✅ Designed for NinjaTrader 8

Who is it for?

Perfect for breakout traders or anyone looking to capitalize on structural price breaks, trend continuation setups, or as a filter for swing strategies.

TIS_Pivots_Breakout

- Brand: The Indicator Store

- Product Code: TISPIVOTSBKO

- Availability: 9

- $250.00

-

$150.00

Related Products

TIS_Price_Action

TIS_Price_Action is an indicator that detects specific pivot sequences (like HH, HL, LL, LH, DT, DB)..

$250.00

Risk Disclosure

RISK DISCLOSURE :

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

HYPOTHETICAL PERFORMANCE DISCLOSURE :

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

-200x200.png)