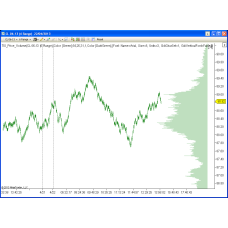

This indicator will show the total volume traded at each price with a 1 tick resolution no matter what timeframe you are using.

The user can reset the volume averaging count to make it start at any time in the chart.

By default, the indicator will average all the volume seen on the whole data loaded by the chart.

User can specify all visual settings ; font, colors, margins, etc.

Related Products

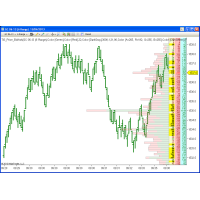

TIS_Price_BidAsk

This indicator shows the total BIDS and ASKS per Price since the last time the indicator was loaded ..

$299.00

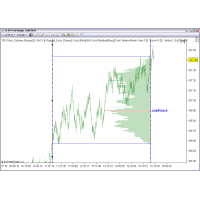

TIS_Price_Volume_Range

This indicator draws a real time volume profile with user defined Range Limits. Adding a vertica..

$220.00

Risk Disclosure

RISK DISCLOSURE :

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

HYPOTHETICAL PERFORMANCE DISCLOSURE :

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.